Navigating The Landscape Of FSA-Eligible Products: A Comprehensive Guide

Navigating the Landscape of FSA-Eligible Products: A Comprehensive Guide

Related Articles: Navigating the Landscape of FSA-Eligible Products: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape of FSA-Eligible Products: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of FSA-Eligible Products: A Comprehensive Guide

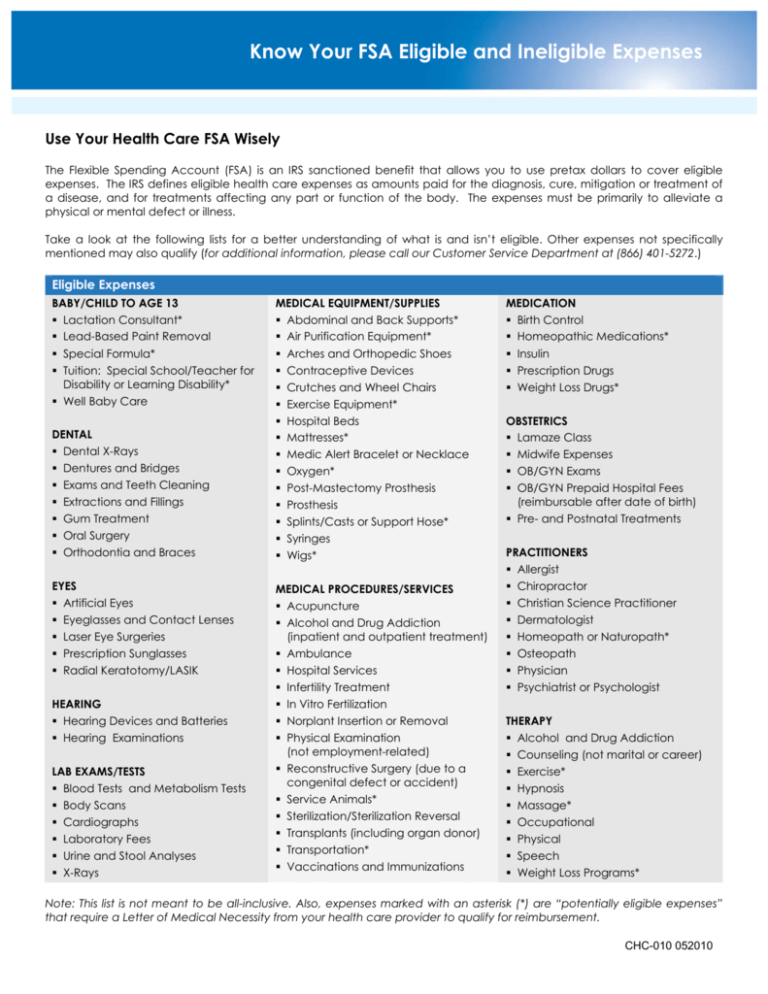

The Flexible Spending Account (FSA) provides a valuable opportunity for individuals to set aside pre-tax income for eligible healthcare expenses. This guide aims to demystify the intricacies of FSA-approved products, offering clarity on what qualifies and how to maximize its benefits.

Understanding the FSA Landscape

The FSA operates on a "use it or lose it" principle, meaning unused funds at the end of the plan year are typically forfeited. This emphasizes the importance of careful planning and understanding the scope of eligible expenses.

Defining the Boundaries: What Qualifies?

The IRS sets the criteria for FSA-eligible products, which encompass a wide range of healthcare-related items. These include:

- Over-the-counter (OTC) medications: This category includes a vast array of common medications like pain relievers, allergy medications, cold and flu remedies, and first aid supplies. It’s crucial to note that some OTC products may not be eligible, so it’s always best to consult the IRS guidelines or your FSA administrator for specific details.

- Prescription medications: All prescription drugs, whether dispensed by a pharmacy or obtained through a doctor’s office, are eligible for FSA reimbursement. This includes both brand-name and generic medications.

-

Medical equipment and supplies: This broad category encompasses a variety of items, including:

- Durable medical equipment: Examples include walkers, wheelchairs, crutches, nebulizers, and CPAP machines.

- Medical supplies: This category includes items like bandages, gauze, syringes, and diabetic supplies.

- Contact lenses: Both prescription and non-prescription contact lenses are eligible.

- Vision care: Expenses related to vision care, such as eye exams, eyeglasses, and contact lens solutions, are eligible for FSA reimbursement.

- Dental care: Dental expenses, including cleanings, fillings, extractions, and dentures, are eligible for FSA reimbursement.

- Hearing care: Hearing aids, batteries, and other hearing care equipment are eligible for FSA reimbursement.

- Mental health care: Expenses related to mental health care, such as therapy sessions and medication, are eligible for FSA reimbursement.

- Alternative therapies: Certain alternative therapies, such as acupuncture, massage therapy, and chiropractic care, may be eligible for FSA reimbursement. However, it’s essential to confirm eligibility with your FSA administrator.

Navigating the Grey Areas: Items that May Not Be FSA-Eligible

While the scope of FSA-eligible products is extensive, there are some items that are generally not covered. These include:

- Cosmetic procedures: Cosmetic procedures that are purely for aesthetic reasons are typically not eligible for FSA reimbursement.

- Non-prescription vitamins and supplements: While some vitamins and supplements may be medically necessary, they are generally not eligible for FSA reimbursement.

- Weight-loss programs: Weight-loss programs are typically not eligible for FSA reimbursement unless they are medically necessary.

- Life insurance premiums: Life insurance premiums are not eligible for FSA reimbursement.

- Long-term care insurance premiums: Long-term care insurance premiums are not eligible for FSA reimbursement.

Maximizing Your FSA Benefits: Strategies and Tips

- Plan ahead: Estimate your healthcare expenses for the year and choose a FSA contribution amount that aligns with your needs.

- Keep receipts: Maintain detailed records of all FSA-eligible expenses, including receipts and invoices.

- Shop around: Compare prices for medical supplies and equipment to ensure you’re getting the best value.

- Utilize the FSA during open enrollment: Enroll in an FSA during your employer’s open enrollment period to maximize your savings.

- Consider a health savings account (HSA): If you have a high-deductible health plan, an HSA may be a better option for you.

FAQs Regarding FSA-Approved Products

Q: Can I use my FSA for over-the-counter medications that I buy online?

A: Yes, you can use your FSA for OTC medications purchased online, provided that the retailer is a reputable source and the products are eligible for FSA reimbursement.

Q: Can I use my FSA for a medical procedure that is not covered by my health insurance?

A: Yes, you can use your FSA for medical procedures that are not covered by your health insurance, as long as the procedure is considered medically necessary.

Q: Can I use my FSA for my spouse’s or children’s medical expenses?

A: Yes, you can use your FSA for your spouse’s and children’s medical expenses, as long as they are dependents on your tax return.

Q: Can I use my FSA for medical expenses incurred before I enrolled in the FSA?

A: No, you cannot use your FSA for medical expenses incurred before you enrolled in the FSA.

Q: Can I use my FSA for medical expenses incurred after I terminate my employment?

A: No, you cannot use your FSA for medical expenses incurred after you terminate your employment.

Conclusion

FSA-approved products offer a significant opportunity for individuals to save money on healthcare expenses. By understanding the eligibility criteria, planning ahead, and utilizing the available resources, individuals can maximize the benefits of this valuable program. It is crucial to stay informed about the latest updates and regulations, ensuring that your FSA utilization remains compliant with the IRS guidelines. Remember, careful planning and awareness can empower you to navigate the landscape of FSA-approved products effectively, ultimately leading to greater financial well-being.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of FSA-Eligible Products: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!