Navigating Healthcare Costs: A Comprehensive Guide To Flexible Spending Accounts (FSAs)

Navigating Healthcare Costs: A Comprehensive Guide to Flexible Spending Accounts (FSAs)

Related Articles: Navigating Healthcare Costs: A Comprehensive Guide to Flexible Spending Accounts (FSAs)

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Healthcare Costs: A Comprehensive Guide to Flexible Spending Accounts (FSAs). Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Healthcare Costs: A Comprehensive Guide to Flexible Spending Accounts (FSAs)

The ever-increasing cost of healthcare is a significant concern for individuals and families across the United States. Navigating this complex landscape requires careful planning and strategies to mitigate financial strain. One such strategy, gaining increasing popularity, is the utilization of Flexible Spending Accounts (FSAs). This guide delves into the intricacies of FSAs, their benefits, and how they can effectively contribute to managing healthcare expenses.

What are Flexible Spending Accounts (FSAs)?

FSAs are employer-sponsored accounts that allow employees to set aside pre-tax dollars to pay for eligible healthcare expenses. The funds are deducted from an employee’s paycheck throughout the year and deposited into the FSA account, reducing their taxable income. This pre-tax treatment results in immediate tax savings, allowing employees to stretch their healthcare dollars further.

Types of FSAs:

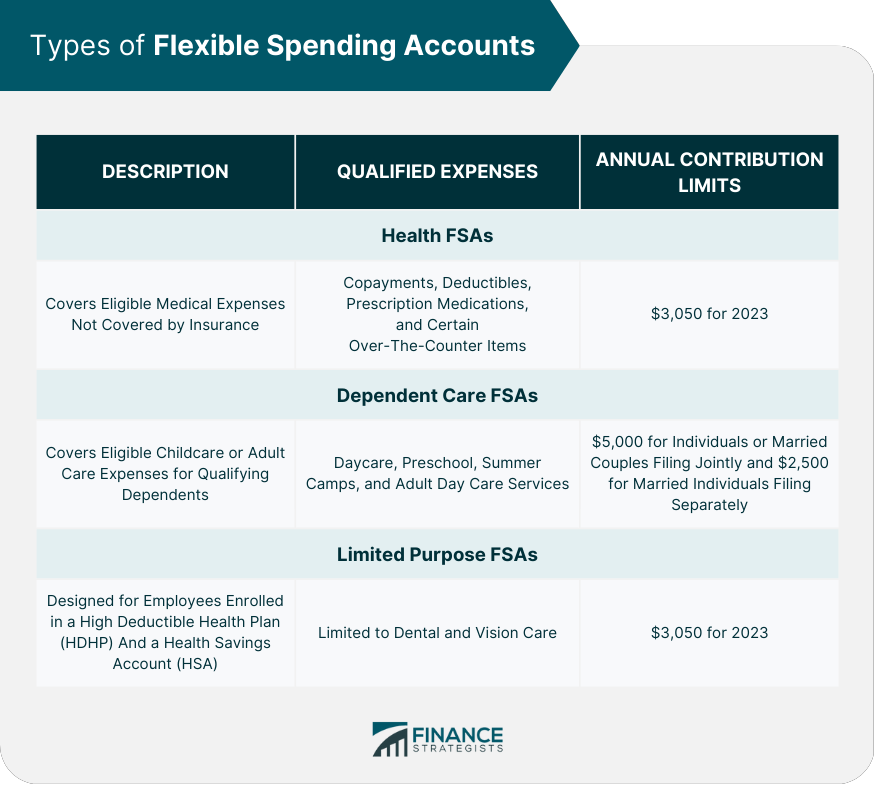

There are two primary types of FSAs:

- Healthcare FSAs: These accounts cover a wide range of medical expenses, including deductibles, copayments, coinsurance, prescription drugs, and over-the-counter medications (with a prescription).

- Dependent Care FSAs: These accounts assist with childcare and elder care expenses, enabling employees to pay for services like daycare, after-school programs, and adult care facilities.

Key Advantages of FSAs:

- Tax Savings: By using pre-tax dollars, employees can reduce their taxable income, leading to significant tax savings.

- Cost Control: FSAs help individuals budget for healthcare expenses, making it easier to plan and control out-of-pocket costs.

- Access to Affordable Healthcare: FSAs can make healthcare more accessible by covering expenses that might otherwise be difficult to afford.

- Flexibility: Employees can choose the amount they contribute to their FSA each year, allowing for customization based on individual needs and circumstances.

Understanding the Mechanics of FSAs:

- Enrollment: Employees typically enroll in an FSA during their company’s open enrollment period.

- Contributions: Employees choose a contribution amount to be deducted from their paycheck each pay period.

- FSA Card: Most employers provide employees with a debit card linked to their FSA account.

- Expense Reimbursement: Employees use their FSA card to pay for eligible expenses directly or submit receipts for reimbursement.

- Year-End Deadline: Funds in an FSA generally expire at the end of the plan year, meaning any unused funds are forfeited. Some employers offer a grace period or rollover option.

Eligibility and Restrictions:

- Employer-Sponsored: FSAs are offered through employers, so eligibility depends on the employer’s participation in the program.

- IRS Eligibility: Only eligible expenses as defined by the Internal Revenue Service (IRS) can be paid for using FSA funds.

- Contribution Limits: There are annual contribution limits for FSAs, which are adjusted periodically by the IRS.

Navigating Common FSA Questions:

1. What Expenses are Eligible for FSA Reimbursement?

The IRS defines a comprehensive list of eligible expenses, including:

- Medical Expenses: Deductibles, copayments, coinsurance, prescription drugs, over-the-counter medications (with a prescription), medical supplies, doctor visits, hospital stays, dental care, vision care, mental health services, and more.

- Dependent Care Expenses: Childcare, elder care, and other qualifying services for dependents.

2. Are There Any Expenses That are Not Eligible?

Certain expenses are not eligible for FSA reimbursement, such as:

- Cosmetic Procedures: Cosmetic surgery, hair transplants, weight-loss programs, and similar services are typically excluded.

- Over-the-Counter Medications: Without a prescription, over-the-counter medications are generally not eligible.

- Life Insurance Premiums: Life insurance premiums are not covered by FSAs.

- Long-Term Care: Long-term care insurance premiums are not eligible.

3. How Can I Avoid Forfeiting Unused FSA Funds?

- Grace Period: Some employers offer a grace period of up to two and a half months after the plan year ends to use remaining FSA funds.

- Rollover: The IRS allows a limited rollover of up to $550 for health FSAs, but not for dependent care FSAs.

- Catch-Up Contributions: For individuals aged 55 and older, there is a catch-up contribution limit allowing them to contribute an additional amount to their FSA.

4. What Happens if I Change Jobs or Leave My Employer?

If you leave your employer, you may be able to continue using your existing FSA funds for a limited period, depending on your employer’s policies.

5. How Can I Make the Most of My FSA?

- Estimate Expenses: Carefully estimate your annual healthcare and dependent care expenses to determine the appropriate contribution amount.

- Track Expenses: Keep detailed records of all eligible expenses to ensure accurate reimbursement.

- Utilize FSA Cards: Use your FSA card for eligible expenses to streamline the reimbursement process.

- Consider the Grace Period or Rollover: If you anticipate having unused funds, explore the options offered by your employer to maximize your savings.

Tips for Effective FSA Utilization:

- Plan Ahead: Estimate your healthcare and dependent care expenses for the year to determine your contribution amount.

- Review Eligibility: Familiarize yourself with the IRS guidelines for eligible expenses to avoid potential reimbursement issues.

- Keep Records: Maintain detailed records of all eligible expenses, including receipts, invoices, and medical statements.

- Communicate with Your Employer: If you have questions or concerns, contact your employer’s human resources department for clarification.

- Utilize FSA Card: Use your FSA card for eligible expenses for a seamless reimbursement process.

Conclusion:

Flexible Spending Accounts offer a valuable tool for managing healthcare costs and maximizing financial well-being. By utilizing pre-tax dollars, individuals can reduce their tax burden and control out-of-pocket expenses. Understanding the mechanics of FSAs, eligible expenses, and contribution limits is crucial for maximizing their benefits. By following the tips and guidelines provided, individuals can effectively navigate the complexities of healthcare financing and leverage FSAs to their advantage.

Closure

Thus, we hope this article has provided valuable insights into Navigating Healthcare Costs: A Comprehensive Guide to Flexible Spending Accounts (FSAs). We hope you find this article informative and beneficial. See you in our next article!